Alert

New South Dakota Bills Provide Relief for Lenders

Read Time: 4 minsOn March 13, 2017, South Dakota Governor Dennis Daugaard signed HB 1090 into law, amending recent changes to the South Dakota Money Lender law, S.D. Code § 54-4-36, et seq. HB 1090 now excludes installment sales contracts from the definition of “loans” subject to the recently imposed 36% rate cap. HB 1090 also defines the phrase “fees incident to the extension of credit,” which is used to indicate what fees and charges are subject to the 36% rate cap, in a manner that will exclude certain fees and charges from the rate cap calculation for loans subject to the 36% rate cap. In addition, Governor Daugaard signed SB 166 on March 13, 2017, which excludes certain business-to-business loans from the 36% rate cap.

As discussed in our earlier client alerts, South Dakota voters passed Initiated Measure 21, which prohibited Money Lender licensees, including sales finance companies, from contracting for or receiving greater than a 36% maximum finance charge on loans made pursuant to the Money Lender law. This 36% maximum finance charge was an “all-in” calculation, and in addition to interest, included all fees and charges “incident to the extension of credit.”

In response to questions regarding how to interpret the impact of the changes made by Initiated Measure 21, the regulator, the South Dakota Department of Labor & Regulation, Division of Banking, noted the phrase “fees incident to the extension of credit” could include fees such as late fees, returned check fees, attorney’s fees, and any ancillary products purchased by the consumer. The effect of that interpretation of the 36% rate cap was to functionally impose a much lower rate cap than 36% for most types of “loans” due to the fact that the new rate cap calculation would require lenders to include a number of fees and charges a borrower may incur over the life of the loan, even though such fees and charges may never be incurred and are excluded from the Annual Percentage Rate under the Truth in Lending Act. Because sales finance companies hold Money Lender licenses in South Dakota, as noted above, the restrictively-interpreted 36% rate cap would have applied to retail installment contracts purchased by sales finance companies.

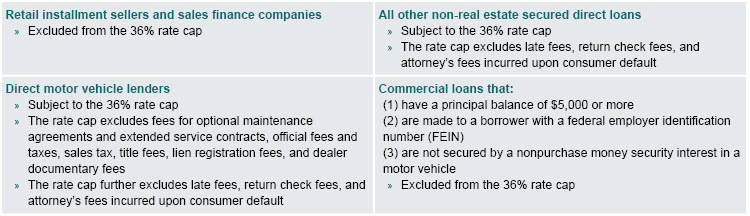

HB 1090 now limits the 36% rate cap only to “loans” made pursuant to the Money Lender law, by amending the definition of “loans” to exclude all installment sales contracts from the scope of the law, regardless of the type of personal property purchased and financed. Accordingly, installment sales contracts are no longer subject to the 36% rate cap.

HB 1090 also adds two additional sections to S.D. § 54-4-44, which currently provides that the 36% rate cap includes all charges for any ancillary product or service and any charge or fee “incident to the extension of credit.” One section relates to direct motor vehicle secured loans, while the other relates to other direct loans subject to the Money Lender law. The impact of each section is discussed below.

First, a section has been added to provide that fees “incident to the extension of credit” in connection with a motor vehicle secured loan do not include fees for optional maintenance agreements and extended service contracts, official fees and taxes, sales tax, title fees, lien registration fees, and dealer documentary fees. Due to the change to the scope of the statute to exclude installment sales contracts, this modification of the 36% rate cap applies only to direct motor vehicle secured loans, and does not apply to direct purchase money loans that are unsecured or secured by other types of personal property.

Second, an additional section has been added to provide that, for all loans, late fees, returned check fees, and attorney’s fees incurred upon consumer default are not fees “incident to the extension of credit.” Accordingly, late fees, returned check fees, and attorney’s fees are not included in the 36% rate cap for any loan subject to the Money Lender Law.

SB 166 excludes business-to-business loans from the 36% rate cap if the loans: (1) have a principal balance of $5,000 or more; (2) are made to a borrower with a federal employer identification number (FEIN); and (3) are not secured by a nonpurchase money security interest in a motor vehicle. The definition of business-to-business loans includes any lending to or in furtherance of a business or commercial venture that is not for personal, family, or household use.

In summary, HB 1090 and SB 166 provide relief from the 36% rate cap to certain lenders and loan products. Lenders making the following loans are impacted by HB 1090:

Please note, however, that the issue of whether Money Lender licensees may charge attorney’s fees has not been fully settled by the passage of HB 1090. Previously, Initiated Measure 21 removed Money Lender licensees from the list of “regulated lenders” entitled to collect reasonable attorney’s fees under the interest and usury statute. While HB 1090 has included “attorney’s fees” in the list of charges excluded from the 36% rate cap, the statute does not expressly grant lenders the authority to charge attorney’s fees. Further, South Dakota law otherwise prohibits attorney’s fees if they are not expressly authorized by statute. Considering the lack of express authorization, we recommend that licensees not charge attorney’s fees in connection with a loan subject to the Money Lender law until such fees are statutorily authorized or a formal Attorney General opinion authorizes the fee.

HB 1090 and SB 166 will take effect July 1, 2017.

If you have questions, please contact one of the authors of this alert or another member of the firm’s Consumer Financial Services Group.